Frequently Asked Questions

Real Estate Asset Management is for investors (small investors up to large family offices) that own an existing portfolio of Real Estate assets or have a desire to expand.

Every investor will have different goals and required a personalized approach and service.

Asset management will connect your physical Real Estate and finance surrounding the company and the assets.

Our focus lies on capital structure, financial modeling, and high-level portfolio strategy in order to increase operational efficiencies.

Another focus will be on the longer-term, strategic big picture of maximizing the value of each rental or investment property in order to achieve the highest Return on Investment (ROI) for the investor.

Property managers deals with more day-to-day operational issues, such as overseeing a properties maintenance and leasing activities.

At Terra REIM we work with vetted partners specialized in property management and experienced Real Estate agents. Our objective is to oversee the implementation of the mapped-out strategy and investment goals.

Residential properties

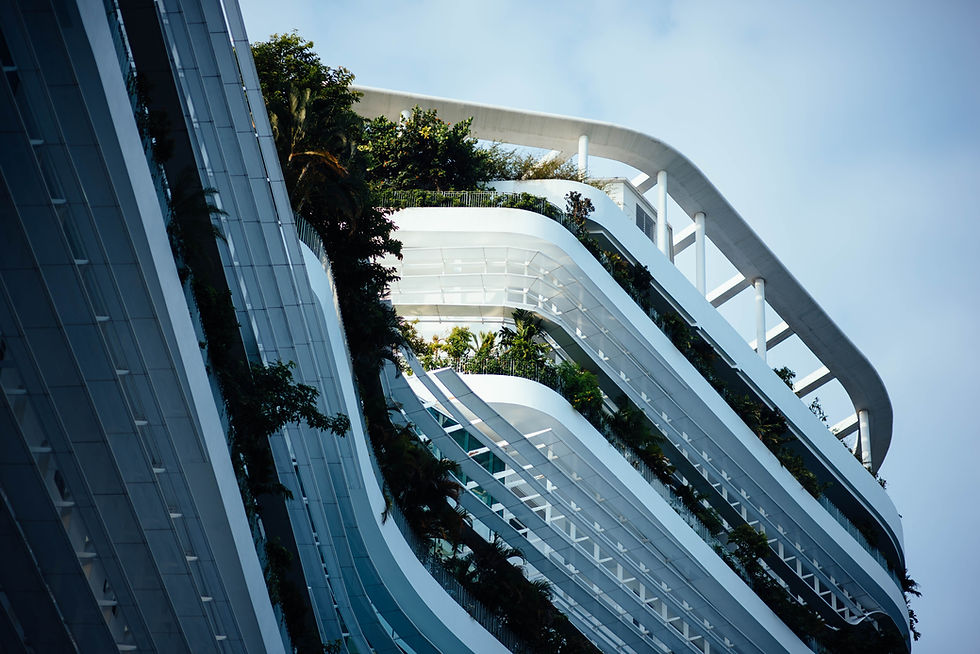

Commercial properties such as office buildings

Mixed-use properties that cater to both businesses and residential tenants

Retail properties such as storefronts

Three Phases of Real Estate Investment Management

Throughout all three phases of real estate asset management – acquisition, holding, and disposition – the asset manager uses his experience combined with market knowledge to help investors improve performance.

Acquisition

Real Estate Asset Managers provide investors with consistent and reliable market data combined with the best time to invest in specific geographic markets.

According to local legislation and financial factors we will structure the investment opportunities for a specific investor.

For example, transaction prices may be rising so fast in some markets that fair market rents may not be high enough to cover debt service and normal operating expenses.

Additional criteria that real estate asset managers use to analyze the timing of potential property acquisitions include:

Interest rates and the cost of capital.

Projected market rent rate movements, absorption and vacancy forecasts.

Opportunity to add value and increase existing income streams.

Market-specific cap rate and yield trends.

Stage of the real estate market cycle.

Hold

Throughout the holding period the real estate asset manager oversees the daily activity of the property manager while constantly monitoring asset performance with an eye on increasing income according to short and long term goals of the investor.

During this period of holding and owning, the asset manager communicates regularly with ownership to measure the financial performance of each rental property against the expectations of the investor and investment strategy goals:

Short-term strategy requires a fast return of capital invested through rapid property appreciation over a shortened holding period.

Long-term strategy focuses on steady cash flow and improved returns through consistent income and market value appreciation over the longer term.

Disposition

Real estate asset managers consider a number of factors when deciding when, how, and even if to sell a rental property.

Some of the factors may include reason for diversification, restructuring the portfolio, political conflicts or cash flow issues.

On the other hand, low cap rates created by a temporary supply shortage in a market with new product under construction may also be a sign that the time has come to sell. That’s because as new supply becomes available, markets often see vacancies rise and rents temporarily decline due to an increase in property for tenants to choose from.

Other reasons for disposing of a specific rental property include:

Future net cash flow is expected to decrease due to the need for upcoming capital improvements such as a new roof or HVAC system.

Unrealized equity has accrued to such a high level that the investor may be able to sell, conduct a 1031 tax deferred exchange, and invest in a diversified portfolio of single-family rental property that is already cash flowing with qualified tenants.

Interest rates are expected to rise due to growing trade wars, political conflicts, or macroeconomic trends that may make cash-out refinancing more difficult and potentially more expensive.

As real estate prices keep rising and the competition for good rental property increases, the demand for professional asset managers who can maximize yields and market values for investors keeps growing.

The best real estate asset managers also go above and beyond the hard data by understanding the subjective nuances of each client.

That is because each investor is unique, based on; investment goals, objectives, background, family situations, work histories, health, financial and knowledge resources, and desires.

In real estate relationships, long-term value is built on more than just a single transaction event. long-view strategies backed by in-depth knowledge of market dynamics and ability to respond to short- and long-term trends in multiple geographies.

Investing in real estate presents challenges that do not exist in capital markets. The property faces the risk of damage and tends to deteriorate over time. Therefore a Real estate asset managemer concerns itself with mitigating risks and promoting valuable improvements.